The Cash App settlement payment method has garnered a lot of attention. Block, Inc., the company that created Cash App, agreed to a $15 million class-action settlement to compensate impacted users after being accused of negligence and data breaches. A new era of convenience and accountability in consumer compensation is heralded by the payout process, which combines traditional paper checks with digital methods like Venmo and PayPal.

Two data incidents that revealed private user information led to this settlement. According to the plaintiffs, Cash App Investing compromised financial data and made fraudulent withdrawals as a result of inadequate security measures to stop illegal access to accounts. Even though Block denied any wrongdoing, the settlement upholds the necessity of corporate transparency in digital banking and offers a framework for impacted users to recover losses.

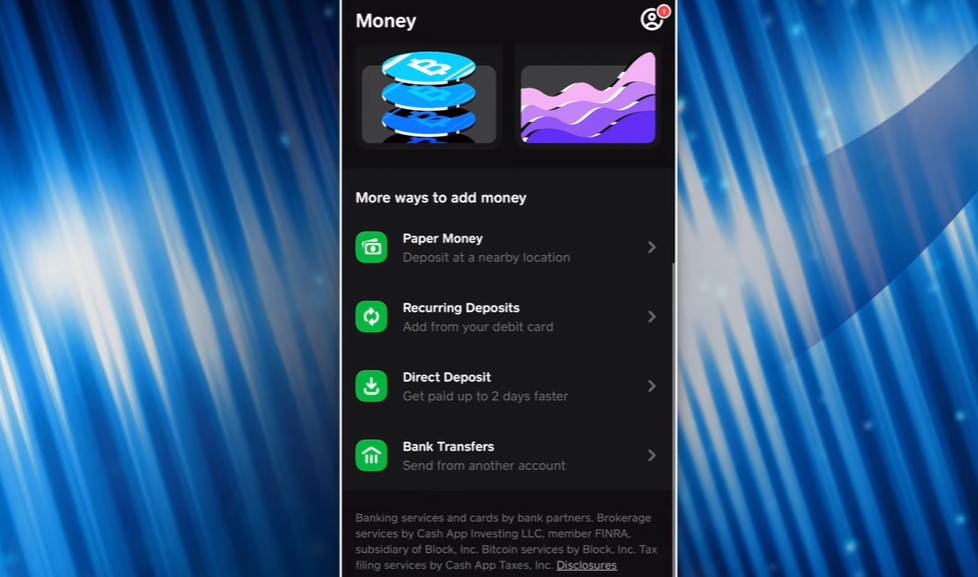

When submitting their forms, claimants were offered three payment options: check, PayPal, or Venmo. Given that both Venmo and PayPal provide almost instantaneous digital transfers, users who choose these services should anticipate receiving their money much more quickly. Despite their dependability, paper checks can take longer because of the verification and mailing procedures. This tri-option model, which lets claimants select the format that best suits their accessibility and comfort needs, has been hailed as especially creative.

These digital approaches feel remarkably similar to the convenience that initially drew users to Cash App. The settlement shows how financial technology can be incredibly effective in not only streamlining everyday transactions but also effectively delivering justice by incorporating contemporary fintech tools into the restitution process. This strategy may soon become the standard for class-action settlements, establishing standards for promptness and openness.

Cash App Settlement Information Table

| Category | Details |

|---|---|

| Case Name | Salinas et al. v. Block, Inc. and Cash App Investing, LLC |

| Case Number | 22-cv-04823 |

| Court | U.S. District Court for the Northern District of California |

| Settlement Amount | $15 million |

| Defendants | Block, Inc. and Cash App Investing, LLC |

| Key Allegations | Negligence, Data Breach, and Mismanagement of User Accounts |

| Eligibility Period | August 23, 2018 – August 20, 2024 |

| Payment Methods | Venmo, PayPal, or Physical Check |

| Final Approval Hearing | January 13, 2025 |

| Reference Source | https://cashappsecuritysettlement.com |

Users who had their Cash App or Cash App Investing accounts accessed without authorization between August 2018 and August 2024 are eligible to participate. To qualify, claimants were required to provide documentation such as bank statements, notification letters, or police reports verifying their losses. Depending on the kind of damages claimed, payments can range from up to $2,500 for confirmed out-of-pocket costs to more money for lost time or fraudulent withdrawals.

The final approval hearing was set for January 13, 2025 by the U.S. District Court for the Northern District of California, which is in charge of the case. The settlement payments will only be made available following judicial confirmation. After distribution starts, claimants who chose Venmo or PayPal should receive their money in a matter of days, while those who are waiting for checks should receive their money in a matter of weeks.

For large-scale cases, the choice to include online payment methods in settlements is especially advantageous. It removes the delays brought on by conventional mailing, guarantees traceable transfers, and lowers administrative expenses. More significantly, it gives claimants more control by converting the laborious paper-based procedure into a simplified digital one. Compared to the laborious check distribution procedures that were popular only a few years ago, this method feels noticeably better.

Additionally, this settlement demonstrates how consumer trust is quickly emerging as financial technology’s most valuable asset. Regulators and industry rivals have been closely monitoring Block’s response to the breach and the restitution process that followed. Businesses such as PayPal, Chime, and Zelle are keeping an eye on this case to see how digital payment companies can bounce back from security issues without losing their reputation. In this way, Cash App’s settlement payment method selection is not only sensible, but also symbolic.

The payment schedule for the settlement is entirely consistent with more general changes in the financial industry. These days, digital transfers are thought to be very effective, environmentally friendly, and less likely to be lost or incorrect. By leveraging these technologies, Cash App reinforces its identity as a forward-leaning brand that integrates innovation into even its most difficult moments. Additionally, the payout design shows a thorough comprehension of customer expectations: people expect to be paid as soon as they send money to a friend, and they no longer want to wait weeks for checks.

This case also highlights how crucial accountability is becoming in the fintech industry. The Consumer Financial Protection Bureau and other regulatory agencies have been keeping a closer eye on how digital platforms manage user data. Because Block had already been fined by the CFPB for comparable violations, the company was under tremendous pressure to improve its security and privacy measures. As a result, the settlement acts as a financial settlement as well as a reputational start, demonstrating that businesses can take proactive, open steps to rectify their errors.