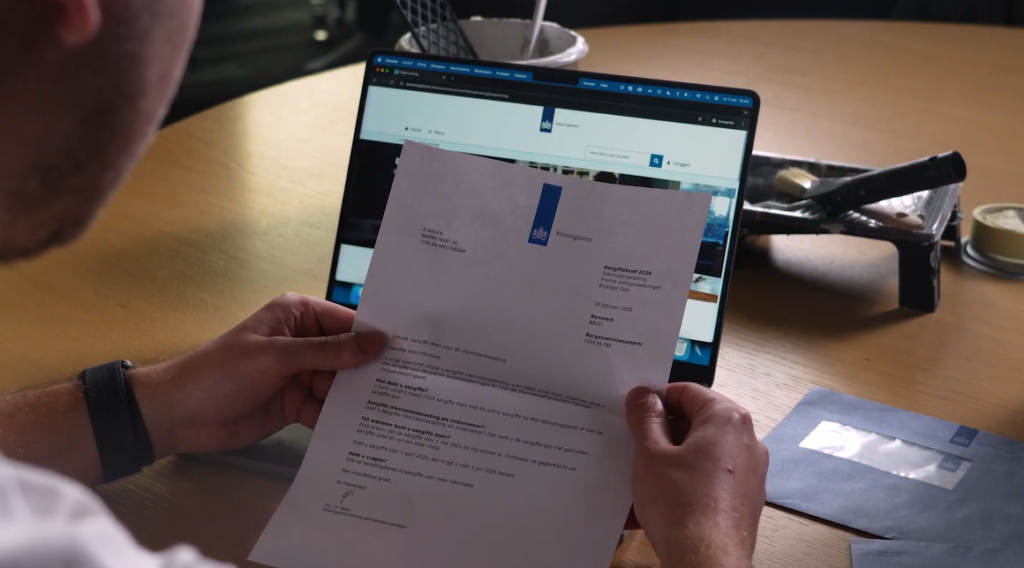

The Voorlopige Aanslag 2026 arrives quietly, typically tucked away in energy bills or shopping fliers, but it is surprisingly important. It appears to be simply another official letter at first glance. A printed sheet having boxes and numbers. However, it is the start of a new financial chapter for more than three million Dutch taxpayers, one that will be influenced by habits, projections, and a changing personal landscape.

The message may serve as a friendly reminder to the 1.4 million recipients of refunds. It informs customers that they can anticipate monthly repayments from the tax office based on data from the previous year, including mortgage interest, deductions, and child care expenses. These aren’t much, but they add up, and they’re especially helpful for families who are trying to balance growing energy costs with fixed expenses. They receive twelve brief reminders that the system is aware of them instead of a yearly bulk amount.

The situation is rather different for the remaining 2.3 million people. They are informed in their letter of the amount they will have to pay gradually rather than all at once. The reasoning behind this is incredibly successful—it lessens the likelihood of receiving a huge tax bill in 2027 and distributes the financial load equally throughout the year. It turns uncertainty into monthly planning that is doable. However, it also requires the recipient to be accurate and alert. Your prior data is used by the tax office. Their assessment may be incorrect if your life has changed since then.

It was perfectly summed up by a part-time photographer I chatted with in Amersfoort. She remarked, “They’re glancing in the rearview mirror, but I’ve already started down a new path.” Her tax profile had completely changed from freelancing to part-time work with benefits. She believed that changing the Voorlopige Aanslag was not only wise, but necessary.

| Key Aspect | Information |

|---|---|

| Issuer | Belastingdienst (Dutch Tax Authority) |

| What It Is | A preliminary tax assessment for 2026, sent to millions of residents |

| Purpose | Estimate of tax due or refundable based on expected income and deductions |

| Sent When | Beginning December 2025 through January 2026 |

| Update Method | Online via Mijn Belastingdienst with DigiD |

| Who Receives It | Over 3.7 million people; 1.4 million for refunds, 2.3 million for payments |

| Flexibility | Can be adjusted throughout 2026 to reflect changing financial situations |

| Reference | belastingdienst.nl/voorlopigeaanslag |

Mijn Belastingdienst is used to make these modifications. Although the terminology is somewhat bureaucratic, the digital site is surprisingly easy to use. You can change income, property, pension, or deduction statistics in a matter of minutes. Update the changes, inspect the previews, and publish without giving it too much thought. After that, the algorithm recalculates and typically provides an updated score in six to eight weeks. This method is easy for most people. Others use it as a prompt to collect documents they haven’t looked at in months.

I now view this letter as a picture of the government’s presumptions about your identity and lifestyle, rather than a tax document. In that sense, it’s strangely personal.

The system’s ability to be revised is what makes it so novel. The Voorlopige Aanslag does not penalize you for changing course in the middle of the year, in contrast to many other fiscal tools. It can be updated as frequently as necessary. Had a kid? Have you changed your mortgage? Early retirement? When appropriately reported, each of these occurrences keeps your monthly tax reality in line with your real life.

Even projection is possible. You can increase your estimate in Q2 and start paying a little bit extra in advance if you anticipate earning more in Q3. Financially literate households quietly employ this very effective tactic. When compared to a year-end reckoning that comes with interest and little leeway, it’s also shockingly inexpensive.

The method does provide special challenges for those who are retired or have several sources of income. Depending on expected pension income, the Belastingdienst may occasionally send an uninvited payment letter. This change may seem sudden to many former workers. However, the reasoning is sound: divide the tax bill into smaller amounts to prevent the shock of a big one. Although it’s not always flawless, the system has significantly improved from previous iterations that lacked flexibility and openness.

The letter encourages introspection as well. Structurally, not emotionally. Do I make more money now than I did last year? Have my deductions been altered? Do I anticipate a different financial result this year? Despite their simplicity, these concerns influence judgments that affect monthly liquidity and financial comfort.

Taxes are never exciting. However, if used carefully, this estimate can serve as a silent budgeting partner—adjustable, largely undetectable, and highly adaptable.

A system that thinks you’re paying attention has merit. It’s a type of trust that seems out of the ordinary for bureaucracy, yet there are tangible financial and psychological benefits when you interact with it. It does more than just get you ready for what’s due. It gives you time to make better choices now, while you still have it.

Many people will forget about the letter as 2026 progresses and let discreet deposits or direct debits take care of it. However, this tax estimate offers alignment in addition to numbers for those who are prepared to look twice. between what your life is truly doing and what the system anticipates. And there is a genuine chance to gain power in that area.