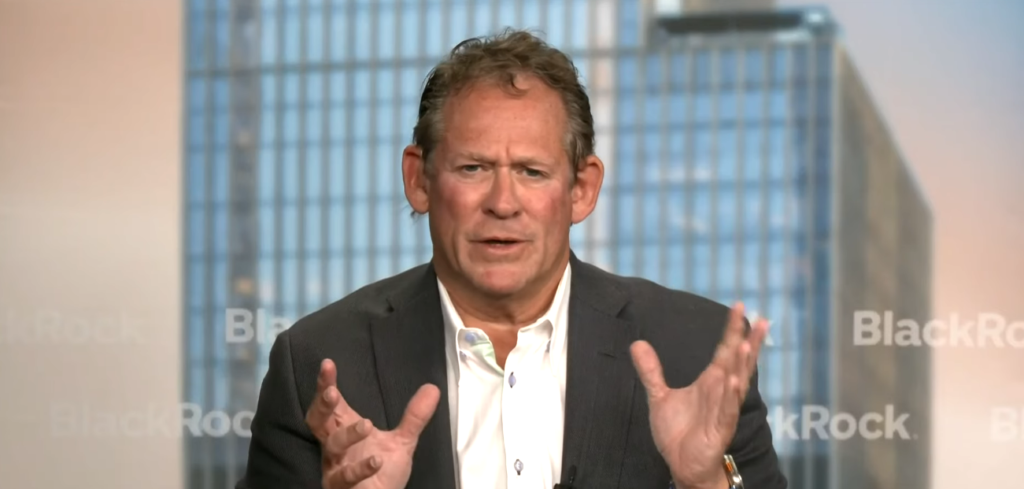

Rick Rieder begins his day long before sunrise, typically plunging into bond spreads before most others have completed their coffee. His ability to manage trillions at BlackRock while interpreting market fears and inflation patterns has made him a voice that investors and, more and more, politicians are paying attention to. He is now being considered for a much more ambitious role: potentially taking over as the Federal Reserve’s next chair.

In recent weeks, prediction markets have moved substantially in his way. Rieder may appear to be an outsider at first because he has never held a formal policy position, has never served on the Federal Open Market Committee, and does not write scholarly articles about monetary mobility. But if you take a closer look, it’s very obvious why he’s leading the field. Throughout turbulent cycles, his ability to accurately read market signals and understand liquidity movements has shown to be surprisingly effective.

Rieder has led BlackRock’s fixed income empire for more than ten years, and he is renowned for striking a balance between practicality and in-depth structural research. He isn’t just reacting to macroeconomic shifts—he’s often anticipating them. By using micro-level data, he analyzes economic momentum like a seasoned sailor reads shifting winds—carefully and with an eye on the greater horizon.

Unlike other more isolated contenders, Rieder thrives in complexity. His observations frequently emphasize how core inflation dynamics are changing due to long-term labor pressures and the growing impact of AI productivity advances. He has recently maintained that these adjustments might support lower rates, a position that is consistent with the tone of the present government without completely caving in to it.

| Full Name | Rick M. Rieder |

|---|---|

| Education | Emory University (1983), Wharton School (1987) |

| Current Role | CIO of Global Fixed Income at BlackRock |

| Assets Managed | Approximately $2.7 trillion in fixed income assets |

| Career Highlights | Former Lehman Brothers MD; joined BlackRock in 2009 |

| Reputation | Pragmatic, data-driven, market-oriented leader |

| Public Profile | Frequently cited in financial media and policy circles |

| Potential Appointment | Finalist for U.S. Federal Reserve Chair (2026) |

| External Reference | https://www.blackrock.com/about-us/leadership/rick-rieder |

During a recent interview, he calmly acknowledged that financial realities typically shift more fast than policy frameworks. I paused on that line—it was extraordinarily clear in its meaning, but also revealed an underlying tension between market mobility and institutional rigidity.

This is exactly where Rieder’s strength may lie. He is not bogged down by intellectual formalism. Instead, he advocates a data-rich, real-time feedback loop. In a period where quick shifts—from energy costs to tech labor demand—can reverberate internationally within days, this perspective feels not only contemporary but exceptionally inventive.

Not everyone is persuaded, though. Rieder’s closeness to BlackRock, the biggest asset manager in the world, has drawn criticism for potentially undermining views of Fed independence. The optics of selecting someone so steeped in private markets to a public institution entail risks—even if the structure of the Fed prevents any single figure from controlling decisions.

A certain amount of professional neutrality is also evident in Rieder’s record of nonpartisan donations. He’s contributed to both Republican and Democratic politicians, from Nikki Haley to Pete Buttigieg. That neutrality, while seemingly balanced, challenges his potential appointment in a political context where allegiance is cherished, and dissent is punished.

However, it is hard to discount his qualifications if the issue is one of talent rather than compliance. Rieder’s stint at Lehman Brothers provided him a front-row seat to the fragility of unrestrained leverage. He has mapped the relationship between credit and policy in great detail throughout his years at BlackRock.

For early-stage policy debates, his ability to translate balance sheet mechanics into investor language would be incredibly efficient. Rieder frequently uses examples based on corporate activities and bond market conduct to cut through decisions that others could veil in economic theory.

He has also placed a strong emphasis on communication clarity, which may be especially helpful in rebuilding public confidence in a Fed that is frequently accused of speaking in code. Market participants admire his routine, which favors steady, consistent updates over sweeping storylines. The language is more tactile and less dramatic.

In the next years, the Fed is likely to face a more difficult monetary situation. The dual mandate is still in place, but the inputs—from demographic changes to AI-driven productivity—are changing. Rieder is acutely aware of this transition, regularly pointing out how standard models must now account for variables previously viewed as marginal.

He believes that better data enhances discretion rather than replacing it. For a central bank that is coming under more and more scrutiny, that is a noticeably better strategy. He doesn’t offer certainty. Rather, he provides responsiveness.

Rieder’s approach leans adaptive at a time when some institutions are delving deeper. That does not imply carelessness. It means listening longer, responding faster, and anchoring policy not in academic orthodoxy but in observed behavior. And in this context, that might be exactly what the Fed needs—an analytical pilot with both hands on the controls and eyes on the clouds.

Whether or whether he obtains the chairperson, Rieder has already changed how monetary leadership is being debated. As a shift toward fluency, flexibility, and the capacity to move with conviction when circumstances call for it, rather than as a do-or-die situation. Surprisingly, that could end up being his candidacy’s most lasting legacy.