For millions of Americans, tax season is about more than just filling out paperwork; it’s about getting back on track financially. TurboTax, which is well-known for its user-friendly layout and design, is currently gaining new attention thanks to its Flex Loan function, which gives customers early access to their returns without having to wait for IRS processing.

The Flex Loan essentially functions as a free advance on your anticipated tax return. Those who meet the requirements can obtain up to $4,000, sometimes as soon as 24 hours after the IRS accepts their return. For freelancers or families who depend on those early cash to pay for necessary January and February costs, such as past-due energy bills, rent, or tuition deposits, that speed is very helpful.

The method is incredibly effective since it is so inconspicuous. Eligible filers finish the application completely within TurboTax rather than browsing third-party apps or faxing financial records. A Turbo Visa Debit Card is used to get the loan, which was given through a partner bank, after the IRS confirms receipt of the return. It’s a surprisingly simple method that was created with urgency in mind.

TurboTax avoids subjecting its customers to conventional credit checks or interest-bearing contracts by working with lending organizations like First Century Bank. You should be eligible if the platform’s requirements are met and your expected refund includes direct deposit setup. The approval window for early filers, especially those who file in late January or early February, opens and closes swiftly, usually by the end of February.

It feels like a really novel change for the frequently sluggish tax preparation sector. TurboTax has successfully combined convenience and trust, even though rivals have experimented with refund advances in the past. If you are eligible, there are no out-of-pocket expenses, no stack of paper applications, and no need to visit a storefront.

Ensuring that the return is correct and devoid of IRS red flags is crucial for users. Deductions or conflicting documents may cause clearance to be delayed. Due to federal anti-fraud procedures, for instance, you might anticipate a slight wait if you are claiming the Earned Income Tax Credit (EITC). TurboTax usually eliminates the guesswork by telling users right away if their return qualifies for the Flex Loan.

Table: TurboTax Flex Loan Application Overview

| Attribute | Details |

|---|---|

| Loan Program Name | TurboTax Flex Advance Loan |

| Provider | Intuit Inc. in partnership with WebBank and First Century Bank, N.A. |

| Loan Range | $350 – $2,000 |

| APR Range | 15% – 33%, depending on applicant’s financial profile |

| Eligibility | U.S. resident, at least 18 years old, valid Social Security number, verified bank account |

| Filing Requirement | Must file or have filed a federal tax return using TurboTax |

| Application Timing | Offered during the TurboTax filing process |

| Repayment | Due by April 1, 2026, through refund or manual payment |

| Fees | No upfront fees or penalties for early repayment |

| Reference Link | TurboTax Support – https://ttlc.intuit.com |

I’ve been using TurboTax personally for the last five seasons. Last January, a buddy told me that she received her Flex Loan in less than 36 hours, and I remember being very amazed by how well it worked for her.

Although TurboTax does not charge interest or fees for these loans, there is a slight catch: repayment may still occur automatically through your refund if the IRS sends a refund that is less than expected or takes longer than anticipated. The user can be responsible for the difference if the refund is less than the loan amount, albeit this is uncommon.

When it comes to operations, the Flex Loan is very effective. Instead of using standard credit rating, the algorithmic underwriting process is centered mostly on refund eligibility. This eliminates obstacles for those who may not be eligible for traditional loans but yet anticipate a sizable return. It’s especially helpful for students, gig workers, and other responsible yet financially stressed individuals.

The Flex Loan is not marketed by TurboTax as a cash advance, which is noteworthy. And it’s deliberate. This solution, in contrast to high-interest financial products, markets itself as a client loyalty tool that provides value without charging fees. Each year, that framing has been successful in retaining users on the platform.

The increase in mobile tax filing over the last ten years has greatly decreased the intimidation factor associated with taxes. Uncertainty around the timing of refunds, however, continues to cause anxiety for many households. The Flex Loan eases that stress, enabling users to make more assured plans. Additionally, it’s a calculated strategy for TurboTax to satisfy actual, seasonal financial demands while increasing customer retention.

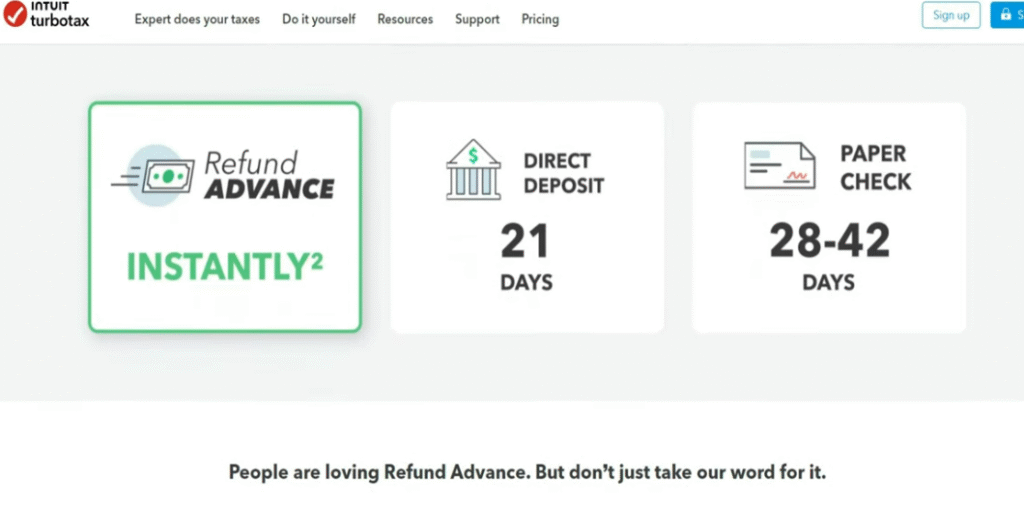

Since the IRS processes the majority of returns in less than 21 days, some critics contend that refund advances are unnecessary. However, waiting even ten days might be financially crippling for a parent whose car breaks down in the middle of winter or a student who needs to get housing deposits. With no long-term commitments, the Flex Loan provides instant stability.

The service draws attention during the first wave of tax season, a limited but crucial window, by using digital integration and careful scheduling. People frequently apply quickly and don’t even realize they’ve left the tax prep flow. It’s a very clever idea, and especially sticky for TurboTax.

By streamlining the procedure and eschewing interest charges, TurboTax’s Flex Loan has established itself as a comfort rather than merely a product. It reflects a deep-seated confidence that many Americans have in their yearly tax process. In terms of seasonal financial instruments, it’s not just very adaptable but also shockingly inexpensive.

The experience has significantly improved over time for early adopters of this functionality. As more customers look for quicker, safer, and less stressful methods to handle their money during refund season, what was once a specialized service is now one of the platform’s most notable features.