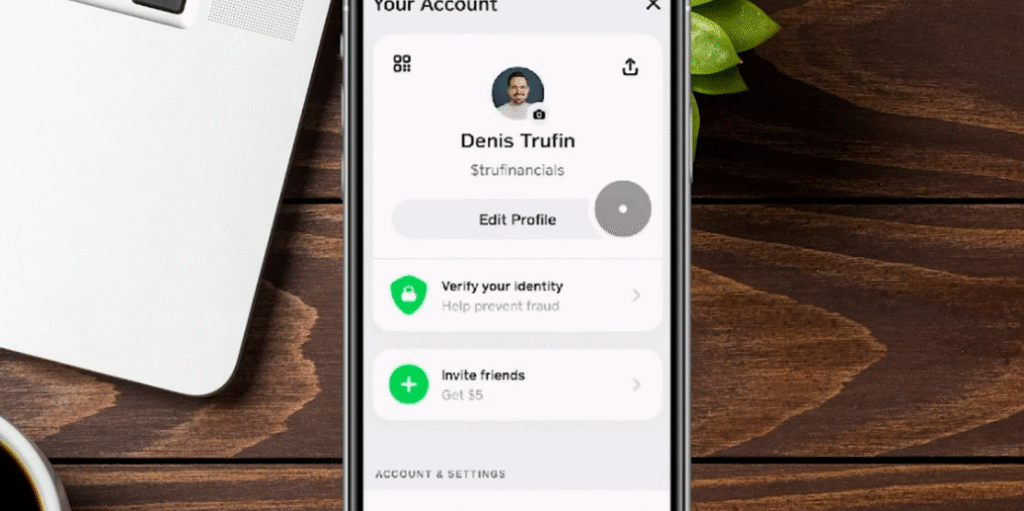

Cash App’s $12.5 million class action settlement has become one of the year’s most talked-about privacy cases. What started out as a seemingly innocuous “Invite Friends” feature eventually led to legal challenges that raised concerns about how tech companies interact with their customers. A straightforward idea at the center of the case was that permission matters.

Block, Inc. was sued by residents of Washington, who claimed the company sent automated referral texts without their express consent, in violation of consumer protection laws. The $12.5 million settlement shows a noticeably increased sense of accountability among digital payment platforms, even though the company denied any wrongdoing. For those impacted, this case served as a reminder that consent should never be sacrificed for convenience.

Promotional messages offering eligible users between $88 and $147 that were sent between late 2019 and August 2025 are covered by the settlement. Even though these payments are small, they represent something much bigger: the understanding that digital boundaries need to be respected. The court’s final approval hearing is scheduled for December 2, which is a significant date for those who support digital privacy.

As stipulated in the agreement, eligible claimants had to turn in their paperwork by October 27. The online procedure was very effective; users were asked to confirm that they had received unsolicited referral texts and to validate their phone numbers. The money left over after administrative expenses are subtracted will be split equally among the claimants. The average payout conveys a remarkably clear message about responsibility in digital marketing, even though it won’t make anyone wealthy.

Table: Cash App Class Action Settlement Overview

| Attribute | Details |

|---|---|

| Company Name | Block, Inc. (Parent company of Cash App) |

| Settlement Amount | $12.5 million |

| Lawsuit Name | Bottoms v. Block Inc., Case No. 2:23-cv-01969-MJP |

| Jurisdiction | U.S. District Court for the Western District of Washington |

| Eligible Period | November 14, 2019 – August 7, 2025 |

| Eligible Participants | Washington residents who received unsolicited “Invite Friends” texts without consent |

| Payment Range | Between $88 and $147 per eligible claimant |

| Claim Deadline | October 27, 2025 |

| Final Approval Hearing | December 2, 2025 |

| Reference Site | Cash App Security Settlement |

The lawsuit was filed under the Consumer Protection Act and the Commercial Electronic Mail Act of Washington. According to the plaintiffs, Cash App encouraged users to invite friends by sending them marketing messages via automated systems without obtaining the recipients’ consent. Despite being a common practice across digital platforms, the practice raised serious concerns about the ease with which personal data could be used for mass promotion.

The class’s lawyer, Beth Terrell, said the case was “a necessary stand against unchecked communication practices.” Her words resonated with millions of people who have become increasingly irritated with unsolicited digital contact. Consumers regained their sense of agency as a result of this settlement, which was a symbolic and useful win.

This incident is more than just a financial settlement for Block, Inc., the company that created Square and the Cash App. The test is one of reputation. Peer-to-peer payments gave the company a huge boost in value, but legal issues like this highlight the fine line that separates expansion from compliance. Other fintech companies, many of which rely heavily on referral-based marketing, have found the case to be especially instructive.

According to industry analysts, the outcome of the case could influence future privacy regulations in the tech sector. Similar lawsuits have been filed against big businesses like Google, Meta, and Amazon for a variety of reasons, from deceptive marketing tactics to illegal data use. Even though the Cash App case is smaller in scope, it demonstrates a particularly creative regulatory strategy: treating digital communications as real marketing activities that must adhere to stringent consent guidelines.

The settlement serves as a concrete reminder to consumers of the benefits of working together. A statement about communication fairness may have developed from what may have begun as personal annoyances with unsolicited texts. Even though these payments are modest, they show that one of the biggest names in fintech has acknowledged that users’ private contact information will not be misused.

Following the announcement of the settlement, social media sites were ablaze with comments. Creators of TikTok made jokes about being “paid for spam,” and Reddit users discussed whether this would cause other apps to scale back their referral schemes. The fact that humor has joined the collective reaction, expressing both awareness and exhaustion over corporate overreach, is especially intriguing.

However, there is a strong undercurrent of advocacy hidden beneath the memes. According to legal experts, this settlement may open the door for more robust state and federal data privacy regulations. Washington’s strong position on digital consent has already prompted lawmakers in other states to look into more stringent laws governing automated messaging. Replicating such policies could drastically cut down on unsolicited digital contact, which many consumers would find to be a very beneficial change.