Stories of consumers getting credit cards they never asked for or accounts they never signed up for started out as a faint echo. The echo became louder over time, until regulators could no longer ignore it. Long praised for its reputation for dependability and trust, Wells Fargo had covertly opened millions of unauthorized accounts. It was a devastating revelation, not just one that was embarrassing.

The problem had grown into one of the biggest banking scandals in American history by 2016. Under pressure from an aggressive sales culture, staff members were accused of “gaming” customer data in order to meet quotas. It was a betrayal of confidence that went right to the heart of personal finance, not just bad practice. Even though the 2025 settlement was reached years after the initial fines, it is still a noteworthy development in the ongoing process of reform and repair.

| Category | Details |

|---|---|

| Case Title | Jabbari et al. v. Wells Fargo & Company and Wells Fargo Bank, N.A. |

| Case Number | 3:15-cv-02159-VC (U.S. District Court, Northern District of California) |

| Settlement Amount | $142 million |

| Time Period Covered | May 1, 2002 – April 20, 2017 |

| Eligible Claimants | Customers whose accounts were opened without consent |

| Types of Compensation | Refunds for fees, credit impact damages, additional distribution |

| Court Approval Date | Finalized June 14, 2018 |

| Oversight Agencies | CFPB, OCC, Federal Reserve |

Many of the more than 3.5 million unauthorized accounts were made without even the tiniest indication of customer consent. Some suffered financial harm as fees, penalties, and enigmatic charges showed up like unwanted visitors. Others found it extremely personal, with loan rejections coming in with mechanical accuracy and credit scores plummeting. Despite its flaws, the $142 million settlement sought to make amends for those wrongs.

The compensation plan was intended to be exceptionally equitable. Consumers who paid for phantom accounts received their money back. For higher borrowing costs, those whose creditworthiness was damaged were compensated further. A tiered system that acknowledged different degrees of loss was used to distribute any remaining funds according to the number of impacted accounts. The symbolism was far more significant even though the average payout was modest.

This case served as a sort of litmus test for corporate responsibility. Similar to how Tesla’s recalls and Apple’s privacy reforms have altered public perceptions, Wells Fargo’s scandal served as a wake-up call for the financial industry. Banks started introducing independent compliance teams, reconsidering incentive schemes, and reevaluating their performance metrics. Ironically, the scandal helped the industry by redefining the parameters of ethical banking, despite the fact that it was expensive.

One of the key players in this story was Carrie Tolstedt, the former head of retail banking. She was charged with deceiving investors and regulators after being a successful executive. Her final guilty plea in 2023 was especially significant because it acknowledged that accountability for leadership cannot be chosen. The resignation of former CEO John Stumpf and his subsequent banking ban also demonstrated how corporate tone establishes ethical direction.

It’s still difficult to measure the psychological toll on consumers. Imagine discovering that someone else took advantage of your savings account, which is your most private financial area, to get their performance bonus. The feelings that survivors of identity theft described were strikingly similar to the sense of violation that many victims expressed. The public apology served as emotional reparation for those customers, while the monetary reimbursement was merely a token.

The impact extended far beyond the marble corridors of Wells Fargo. In addition to fines, regulators implemented extensive oversight reforms. A new era in consumer protection was ushered in by the Federal Reserve’s historic asset cap in 2018, the CFPB’s $100 million penalty, and the OCC’s $35 million sanction. Despite being punitive, these actions were very effective at sending a message that unethical behavior would have structural repercussions.

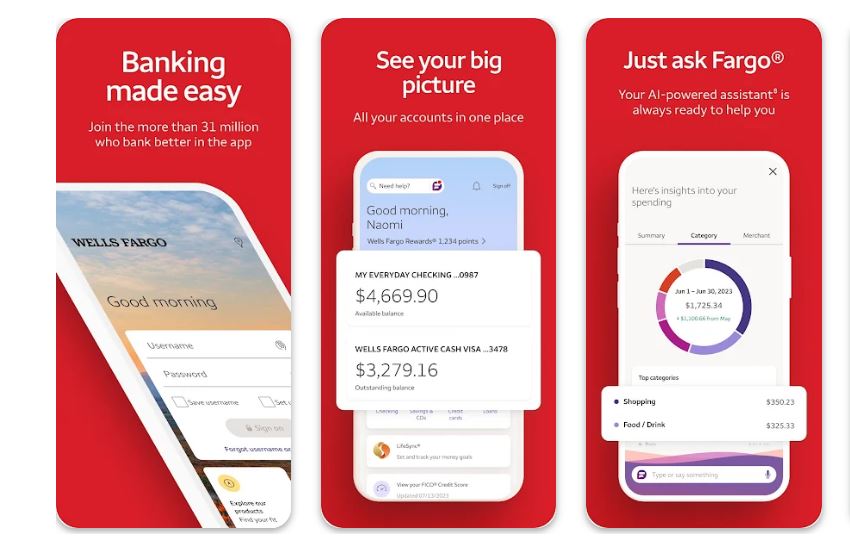

A lot has changed by 2025. Wells Fargo has made significant investments in digital transparency tools since taking on new management. Account authorizations are now displayed in its customer dashboard with remarkable clarity, enabling users to track the origin of each account. Once unimaginable, this degree of visibility has significantly increased consumer confidence. It illustrates how technology, when paired with moral principles, can restore what has been destroyed by reckless ambition.

The fallout from the scandal was remarkably similar to the moral reassessment that followed the 2008 financial crisis from the perspective of the industry. The settlement turned into a corporate cautionary tale: profit margins that undermine trust cannot be sustained. “Reputation now compounds faster than interest,” according to one analyst. Executive bonuses began to incorporate ethical performance indicators, and investors started to place a higher value on governance metrics—a very novel development for corporate America.

The way this story changed consumer behavior is its most fascinating feature. Once passive, clients started to become analytical. They now demand transparency, keep an eye on digital footprints, and question fine print. Perhaps the most beneficial result of the entire episode is this awareness, which has been raised by news coverage and social media. A new generation of consumers arose, one that was considerably less accepting of corporate overreach, more aware, and more watchful.

The cultural impact of the settlement went beyond its financial implications. While late-night hosts made jokes about “phantom checking accounts,” documentaries analyzed the scandal as a symbol of institutional greed. However, a serious discussion emerged amidst the satire: how can we create systems that prioritize honesty over volume? Perhaps the most valuable result of the $142 million payout is that question, which continues to reverberate through boardrooms and business schools.

In contrast, the structure of other corporate settlements, such as Equifax’s data breach payouts or Meta’s privacy fines, appears remarkably similar. Each highlights the fine line that separates profit, trust, and technology. But there’s something particularly human about the Wells Fargo case. The sanctity of consent was at issue, not just the misuse of data.

Customers received small checks as payments were made; some were for a few dollars, while others were for hundreds. Although the sums were modest, the message was profound: once transparency is lost, it can be gradually restored. Wells Fargo’s reform initiatives have significantly improved in recent years, and regulators now refer to the bank as a “reconstructed institution.” Despite its flaws, this change is especially helpful in restoring public confidence in contemporary banking.

Wells Fargo has started to rebrand itself through consistent accountability, leadership transitions, and consumer education. The settlement of the unauthorized accounts serves as both a warning and an example of reform. The scars are still there, but there is definitely growth, much like in a forest that has recovered from a fire.