I remember standing in a packed café on a bleak Boston afternoon a few years ago, watching a cashier tap quickly across a glossy screen with serene assurance, knowing that the system beneath her fingertips would keep things running smoothly. That Toast-powered touchscreen had grown incredibly dependable, coordinating kitchen operations, payments, and orders with an efficiency that was nearly imperceptible until you stopped long enough to see it.

Currently hanging around $27 after plummeting precipitously from previous highs that previously generated amazingly effective confidence among investors, Toast stock exhibits that same quiet dependence, holding expectations far higher than its modest share price might suggest. Even if it was uncomfortable, the decline has greatly cut down on unnecessary excitement, making room for something more long-lasting and possibly more significant.

Restaurants have seen a metamorphosis over the last ten years that is quite similar to the digital revolution that shops went through earlier, embracing software as an operational backbone that supports daily survival rather than just a convenience. With its strategic placement at the heart of that change, Toast has significantly enhanced restaurant management by combining ordering, payroll, analytics, and financial capabilities into a single, incredibly effective system.

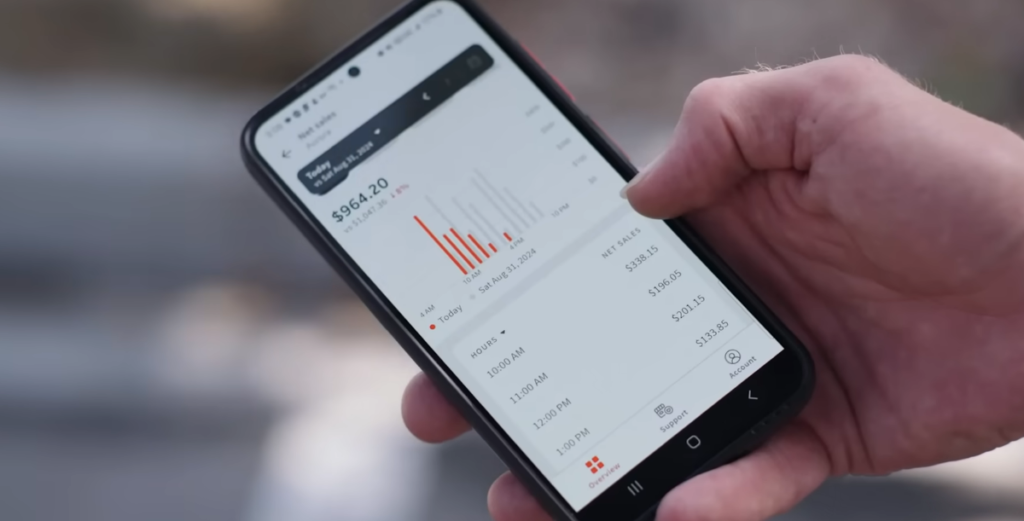

The platform has proven extremely versatile for restaurant owners, enabling them to manage workers, monitor performance while standing on the floor, make menu adjustments, and analyze patterns with clarity that would have been impossible with old technologies. Toast has greatly decreased guesswork by utilizing real-time data, assisting companies in making decisions that seem based on facts rather than intuition.

| Company | Toast, Inc. |

|---|---|

| Founded | 2011 |

| Headquarters | Boston, Massachusetts |

| CEO | Aman Narang |

| Stock Symbol | TOST (NYSE) |

| Recent Share Price | Around $27.33 (February 2026) |

| Market Capitalization | About $16 billion |

| Annual Revenue | Approximately $5.8 billion |

| Core Business | Cloud-based software and financial tools for restaurants |

| Customers | Over 164,000 restaurant locations |

However, utility alone is rarely rewarded by the stock market.

In its most recent quarterly report, Toast’s revenue surpassed $1.6 billion, a surge that would often elicit widespread excitement. However, the company’s share price continued to move gingerly, expressing concerns about long-term margin strength, competition, and profitability. These responses serve as a reminder to investors that change seldom happens in a straight line and emphasize the conflict between financial patience and technical advancement.

Toast has created something incredibly resilient by growing its presence to over 164,000 restaurant locations and becoming ingrained in businesses that would be difficult to run without it. With every new restaurant, its network gets stronger, strengthening a base that seems to be getting more stable with time.

The system has proved notably helpful for small business owners, providing resources that were previously only available to huge organizations and democratizing access to information that can inform strategy and expansion. Once frightening, technology is now shockingly accessible and affordable.

The company’s most recent project, ToastIQ, uses artificial intelligence to automatically evaluate restaurant performance and spot trends and possibilities that human managers might overlook when concentrating on patrons. By working together, these digital assistants streamline processes and give employees more time to concentrate on providing hospitality rather than spreadsheets.

I recall observing how easily employees used Toast’s system while I was standing at a restaurant months ago, as though it had always been a part of their daily routine.

Toast has greatly increased the speed and utility of its platform by incorporating artificial intelligence directly into everyday operations. This allows businesses to react to changes immediately rather than after several days. Once-hour-long tasks can now be finished quickly, increasing productivity and lowering stress.

Naturally, investors have been wary of this change, doubting Toast’s ability to convert technology leadership into long-term financial stability, particularly in light of the company’s stock dropping more than 30% in the last 12 months. However, in the past, these downturns have opened doors, resetting expectations and enabling businesses to regain their reputation.

From a startup with big plans to a business handling billions of transactions annually, Toast has grown steadily since its creation in 2011. Its durability suggests a level of stability that goes beyond what stock charts can show. Its advancement, attained via consistent innovation, is the result of meticulous execution rather than ephemeral impetus.

Toast has strengthened its business model and improved client connections by providing financial services in addition to software, guaranteeing that its platform will always be essential to restaurant operations. Toast has transformed from a basic software provider into a full-service operational partner because to these incredibly successful integrated offerings.

Toast’s current stance seems especially inventive to investors who are prepared to see past short-term swings, since it shows a business making significant investments in future expansion while embracing short-term volatility as a necessary component of long-term growth. Rather than being a sign of weakness, this readiness to invest shows confidence.

Toast’s platform might grow even more essential over time as artificial intelligence becomes more pervasive in restaurant management, assisting with automated decision-making and lowering administrative workloads. Such advancements could strengthen client loyalty and significantly increase profitability.