It began with quiet launches and developed into a worldwide reliance.

Starlink evolved from an ambitious broadband solution to a de facto communications grid by the end of 2025, especially for areas where conventional infrastructure was insufficient. Elon Musk created a system that is not only incredibly self-sustaining but also robust, in contrast to legacy providers.

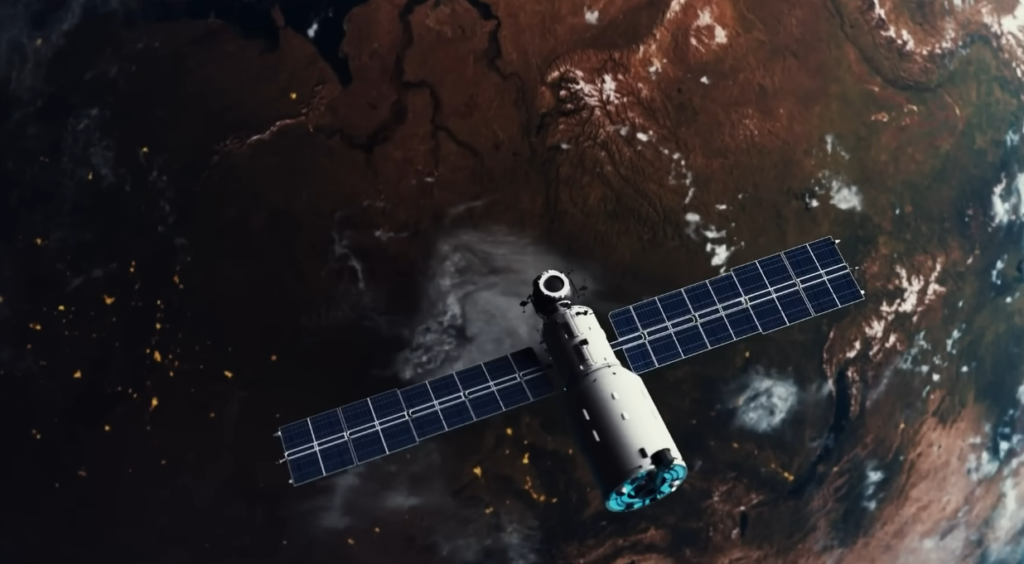

The launch vehicle, base station, and satellite are all vertically integrated components of Starlink’s architecture. Therefore, SpaceX does not need to rely on outside carriers to develop the gear, launch it, maintain the constellation, and distribute the service. Traditional telcos have little opportunity to interfere with this model because it is so inventive and effective.

This domination has become more pronounced during the last 18 months. Based on the tracking source, Starlink currently commands 60% to 90% of all active satellites. The majority fly in low-Earth orbit, covering every inch of the planet with a mesh made of laser interlinks.

It was during the Ukrainian counteroffensive that Starlink’s strength was most noticeable. Musk’s terminals provided encrypted combat coordination for Ukrainian forces. Next was Crimea. There have been rumors that Musk himself deliberately blocked Starlink service in some places.

| Key Topic | Starlink’s Monopoly: Elon Musk’s Telecommunications Power |

|---|---|

| Primary Actor | Elon Musk (CEO of SpaceX, owner of Starlink) |

| Year of Dominance | 2025–2026 |

| Satellite Market Share | Over 9,000 active satellites; 60–90% of global total |

| Core Technology | Low-Earth Orbit (LEO) satellites, laser interlinks |

| Strategic Uses | Ukraine, Gaza, aviation, maritime, emergency comms |

| Competitors | Amazon Kuiper, OneWeb, China’s GuoWang |

| Controversy | Civilian infrastructure vs. military leverage |

| Reference Link | https://www.npr.org/2025/07/04/nx-s1-5453868 |

What we would anticipate from a government, not a CEO, was remarkably similar to the ramifications.

Musk offered to activate Starlink for humanitarian responders in Gaza at about the same time. Political pressure grew within 72 hours, and the offer was withdrawn. That little moment highlighted a critical conundrum: during a crisis, one person may connect—or disconnect—entire regions.

Telecom infrastructure was either severely controlled or public for many years. Starlink, however, evades conventional scrutiny. It isn’t a domestic airline. It’s an orbiting constellation. Governments can provide permits, but they are powerless to control which terminals are operational in times of protest, tragedy, or conflict.

When access is crucial, this form of discretion is very risky. Starlink’s direct-to-smartphone capabilities, which are now in beta, promise to permanently eliminate mobile dead zones, and its satellite-to-ground latency is much faster than that of prior systems. That is an innovation. Depending on the conditions of one organization, however, anyone with a phone may be connected or not.

Starlink has successfully avoided Earth’s bottlenecks by incorporating satellite laser networks. Relays using subsea cables are no longer used. No data center routing via third parties. It’s an unbroken signal. For travelers crossing the Atlantic or ships traversing the Arctic, this is revolutionary.

The pace at which Starlink deploys is even more remarkable. SpaceX is using incredibly effective rocket reuse to launch satellites more quickly than any of its rivals. Over the course of five years, rival space agencies would find it difficult to equal their 80+ successful launches in 2025 alone.

Nevertheless, this advancement has produced a glaring inequality.

Amazon will still need to navigate around Starlink’s already-occupied orbital slots if its Kuiper system ever goes online. GuoWang is creating its own LEO substitute in China, but it is probably going to stay state-bound. OneWeb is up and running, with support from the UK and India, but its capacity and coverage are constrained.

In actuality, Starlink maintains both the spatial and market leadership.

Satellite orbits have gotten more crowded within the last ten years. The deployment of thousands of satellites in close formation by Musk has sparked debates regarding debris and orbital traffic. With each successive launch, the stakes are raised. Eventually, the orbital lanes might just be too crowded for new competitors.

Price power results from this physical supremacy. Starlink is able to provide both customers and institutional partners with remarkably low-cost bundles since it has already amortized the infrastructure. Rural towns, airlines, and cruise lines now depend on Musk’s network to maintain service.

But what happens if Starlink modifies its conditions?

Political risk is the more serious danger. Access has been negotiated with a private organization by governments such as Israel and Ukraine. This is not governed by a treaty. Starlink is under no duty to maintain its neutrality. Additionally, satellite carriers are able to operate legally and literally above municipal jurisdiction, unlike terrestrial telecoms.

For this reason, several analysts are advocating for new global frameworks. Starlink is more than just a supplier of services. It is a telecoms sovereign actor. It also becomes challenging to hold people accountable when geopolitical decisions are taken behind closed doors in Boca Chica or from a Twitter post.

Musk is also shielded from shareholder interference by his refusal to go public with Starlink. Significantly strategic, this decision maintains operational control within a narrow radius. Additionally, it allows Starlink to change its policies or deployments without having to go through drawn-out approval procedures.

Consistency and expansion are advantages for users. However, the reliance on institutions is increasing. NATO has already subtly started utilizing Starlink terminals for field communication during maneuvers in remote areas. Starlink has been integrated into disaster response protocols by emergency agencies from Chile to India. These connections are fundamental and long-lasting.

The problem for the future is striking a balance between innovation and accountability. The effectiveness of Starlink’s model is indisputable. However, efficacy without openness breeds weakness. Any failure, whether ethical or technical, can have a cross-border impact if global communications are supported by a single platform.

On the surface, Starlink’s domination could appear to be a technical achievement. However, there is a deeper, institutional tale. Planetary communications are being consolidated into a single network, managed by a single individual, with no obvious check on decisions or reach.

That’s not merely a telecom issue. It’s related to governance.

And it’s already taking place, orbit by orbit and link by connection.